Every business is born from an idea. An idea that aims to provide something different, something unique. A monetizable solution to a problem that people are willing to pay for. But only a few business ideas make it past the first phase – Becoming real.

Over 99% of business ideas never get past that barrier. But if you’ve made it this far, you are in that 1% willing to take the next step and move forward.

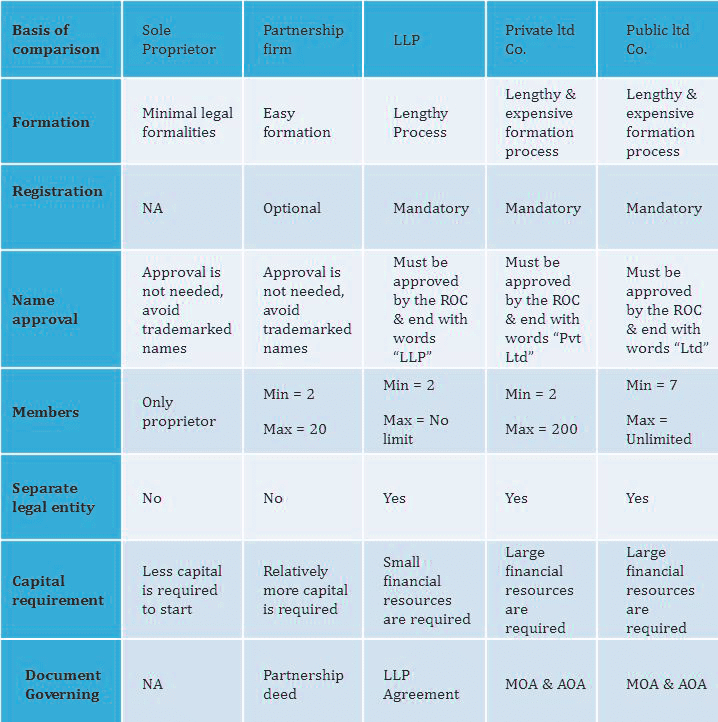

Registrations are a core part of what we do here at Amith & Santosh. Businesses come in all shapes and sizes. From sole proprietorships to Private Limited Companies. But they’re all made official after registration.

But registrations are not as simple as they might seem. Based on the type of business, its nature, scale, purpose, impact and many other factors, the clauses and requirements associated with the registration of different types of businesses are highly unique.

That’s where we come in. Instead of having to worry about what paperwork you need to file, what permissions you need and other blockers, all you need to worry about is what you need to do to make your business work. Leave the complex procedures to us. We’ve been doing it for 4 years and we can seamlessly take care of it for you.